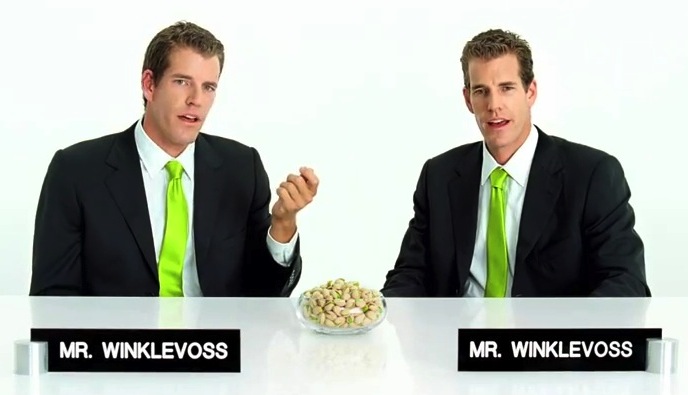

The Winklevoss twins hit the spotlight when they sued Mark Zuckerberg over who conceived the idea that created Facebook. Now they are at it again, making another run on social media through the financial sector. The site is called Sumzero (pretty catchy…), and it is geared toward sharing financial advice between investors. But the real question is: how financially adviseable was this purchase?

The name of the game for the twins is exclusivity. In the beginning, Facebook was only for students, and Sumzero has a selective quality to it as well. Three fourths of all applicants for Sumzero are rejected, according to CIO. And even for those allowed into the tight-knit circle, data comes at a price. Only those who regularly share their investment strategies are allowed to gain access to the plethora of financial advise collected by the social network.

The financial bankroll for the Winklevosses comes from their $65 million settlement in the case against Zuckerberg. With that money, they began Winklevoss Capital – an investment firm – and Sumzero is their first investment. Will the twins be as successful as Zuckerberg with their new endeavor? It all depends on the struggle every social media firm encounters. How can this be monetized? With only 7,500 current members, it’s tough to see where the ROI is for the twins without huge charges for members to be a part of the network. We’ll be keeping an eye on this story. For now it’s safe to say the twins will not be rivaling the value of Facebook any time soon, as its market cap is currently valued at $47 billion.